Postal Supply Chain: Past and Future

Did you know that over 65% of the world’s population gets their mail delivered at home, while, in some areas, over 10% of the population does not have any access to postal services?

It is clear to all of us that postal industry needs to return to its older glory. We have witnessed the postal volumes being degraded over the years while many people think that this industry is collapsing. Our goal with this article is to research on the global postal supply chain sector and identify regions and ways for you to increase your postal revenue and to grow your business.

We have to research deeply and understand a bit more about this industry if we want to find any signs of growth.

Facts about Global Postal Supply Chain

The postal sector currently employs over 5.3 million staff worldwide. It has been estimated that, in 2016, there were 677,347 post offices around the world, with half of them (338,348) being in the Asia-Pacific region while half of these (154,910) are located only in India.

Indeed, in the last 10-15 years, the revenue growth of 10.5% per year since 2005, that was spotted in the postal industry, was driven by Asia-Pacific raising its market share to 32.6%. The Arab region shows fluctuations over the years, sometimes being negative and sometimes positive. In all other regions (e.g. Eastern Europe, Africa, Latin America) the postal revenues tended to steadily underperform each year.

Moving forward, a comparison between domestic and international letter and parcel post will help us to identify any strong or weak points in the postal supply chain industry.

Letter Post

International letter post is estimated at 1.2% of global letter-post volumes. We can see an overall decrease in the volumes of international letter-post since 1991. In Asia Pacific region, there is an increase in letter post volumes since 2014 while all other regions except Eastern Europe, show a steady but rapid decrease over the years. This growth in Asia Pacific market has led to the international letter post being increased by 1.7% in 2015. That is because many small packets related to e-commerce merchandise are being shipped daily across the world.

In the domestic letter post volumes, we can observe a decline of 3.4% in 2016. As you can identify, in industrialised countries, there has been a decrease of 2.6%, while in the Arab area and Latin America, this decrease even reached two-digit rates. The only relative stability for letter post volumes can be seen in the Eastern Europe and CIS region.

All in all, in areas such as Africa, Arab countries, Asia Pacific, Eastern Europe and CIS and Latin America and Caribbean, there is a very small volume of letters shipped each year both internationally and domestically with approximately 1000 million and 50000 million respectively. However, there are some potential markets for investment to letter post and these are located in the Asia Pacific region, most likely due to high e-commerce growth in this area during the previous years.

Parcel Post

When it comes to parcel post, we can see an overall increase in volumes compared to those of letter post. International parcel post accounts for 1.3% of total parcel volumes. In both graphs, about international parcel post and domestic parcel post we can see an increase in global volumes, while we can identify a steady progress in volumes in specific areas. In more details, Eastern Europe and Asia Pacific are regions growing rapidly because of the e-commerce sector. E-commerce has enabled these countries to distribute products across the globe leading to more parcels being moved daily.

Volumes for domestic parcel post have shown a steady increase of 12.5% between 2015 and 2016 but only in certain regions. Parcel post volumes have been risen in industrialized countries and in Eastern Europe but the rest of the world has witnessed many volume fluctuations.

To sum up, if you want to distribute parcels both domestically and internationally, you have to think smart and choose the best areas. In general, the volumes of parcel post are higher than those of letter post and this increase in volumes every year can help you enter a market that will be proven as most profitable for you. Such markets, as said before, are Asia Pacific and Eastern Europe.

Development and Infrastructure

International activities are an important determinant of postal supply chain revenue. Especially, the advent and rapid growth of e-commerce will likely help the postal industry to grow and increase its revenues.

We’ve seen the data for the different types of post (letter and parcel) and we have done an elaborative research both on domestic and international level.

Now, it’s time to break down all the key regions and see if we can find any hidden goldmine that will help you improve your postal revenues.

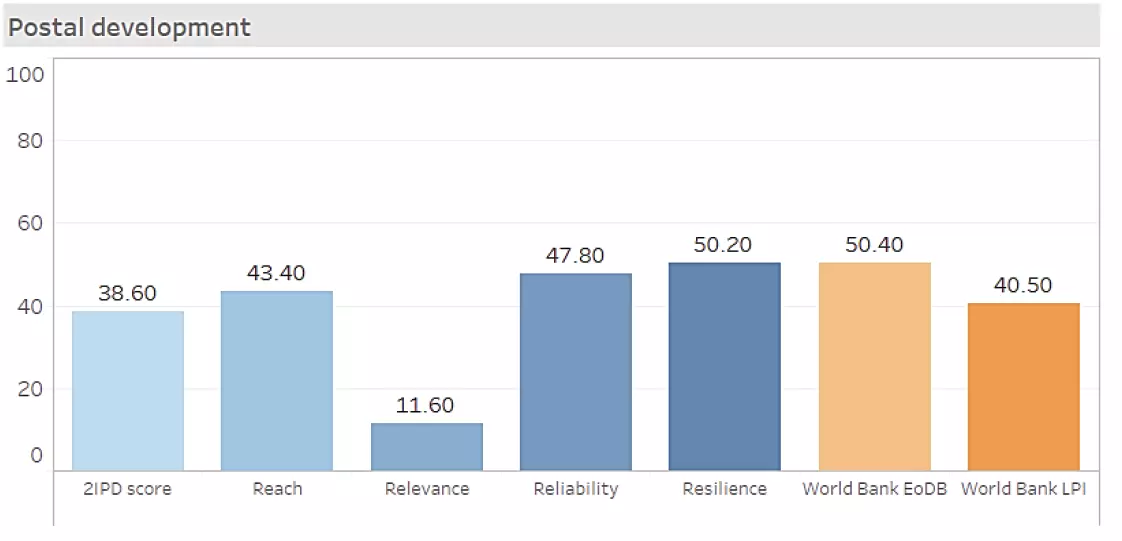

According to the Integrated Index for Postal Development (2IPCD), there are many gaps in postal development and infrastructure among the different regions. Indeed, only a few countries have developed fully organised, reliable and connected postal services.

Africa:

From the table above, it becomes evident that Africa is a region with the second least development in postal services with a score of 25.4/100. The poor infrastructure can be seen in the LPI column and the low levels of Reach and Relevance show the limited allocation of resources to this sector. Yet, it is an area with an average score in Reliability and Resilience, indicating a possible potential in the field of postal supply chain.

Arab Region:

In this region, the average score of postal services is 27.5 which is once again very low. This region has faced many challenges over the years and the result is the underperformance and the lack of logistical infrastructure in achieving high quality postal services. The Relevance score is 0.6 and it is linked to a limited number of transactions processed by postal networks. This particular score indicates why this region fails to achieve larger economies of scale.

Asia-Pacific:

With an average score of 38.9, this area is taking big steps to move forward and develop its processes. Progress is being made to improve the logistical infrastructure but the score of Relevance (13.3) is rather low. This leads us to conclude that there are still many obstacles to overcome, many operators to expand in scale and multiple efforts to be done in order for this region to become one of the most successful in the postal industry.

Eastern Europe & CIS:

Eastern Europe and CIS region seems that its logistical infrastructure outperforms compared to the regions mentioned above. With a general score of 55.1, Resilience score of 67.5 and a Reliability score of 74.7, these areas try to constantly develop their processes and improve the postal services. However, the Relevance score (12.2) in these particular regions is small, meaning that postal services have not yet unlocked the full potential of their logistical infrastructure. As such, opportunities must be seized if we want to increase economies of scale.

Industrialized Countries:

This region holds the highest scores in every category. Industrialized countries are considered countries such as China, India, South Africa, Brazil etc. These regions have high potential when it comes to postal supply chain and the proof is at the score table. With a general score of 67.4 and a Relevance score of 44.3, these countries are leveraging on technology and knowledge to create efficient processes in such a fast-paced environment.

Latin America & Caribbean:

Last but not least, we have Latin America and Caribbean. This region, unfortunately, is assumed to be the least successful. With a 2IPD score of 24.5 and a weak Relevance score of 2.9, Latin America and Caribbean seems unable to improve its logistical infrastructure and develop its postal processes. There is a lack of economies of scales indicating that this region continues to underperform in terms of postal infrastructure. We cannot deny that there is a considerable potential to this market, but it seems that this potential has remained unnoticed and unused.

Postal supply chain industry has suffered great losses during the previous decades. But there are always ways to overcome the challenges. The key aspect that will lead to an improved logistical infrastructure and a successful postal industry is innovation.

If we keep innovating our business model, integrate new technologies and utilise the full potential of a market or a situation, then economies of scale will increase and the postal services will be improved.

Innovation is part of our name and a core value to Haulystic. We always improve our services while using disruptive technology to ensure a unique experience for our clients.

We, at Haulystic Innovations, are specialists in postal supply chain and we can make sure that you will make the right decisions for your business.

Join us and together we will change the landscape of global distribution!

Start by booking your shipments online!

Follow us on